Home »

MMS Strategies

Measure M: More money pours into sales tax battle in Citrus Heights

Latest campaign finance reports filed Thursday show unusually large amounts of money are being contributed to campaigns for the Measure M sales tax proposed in Citrus Heights.

31-point action plan unveiled for Auburn Blvd; funding questions remain

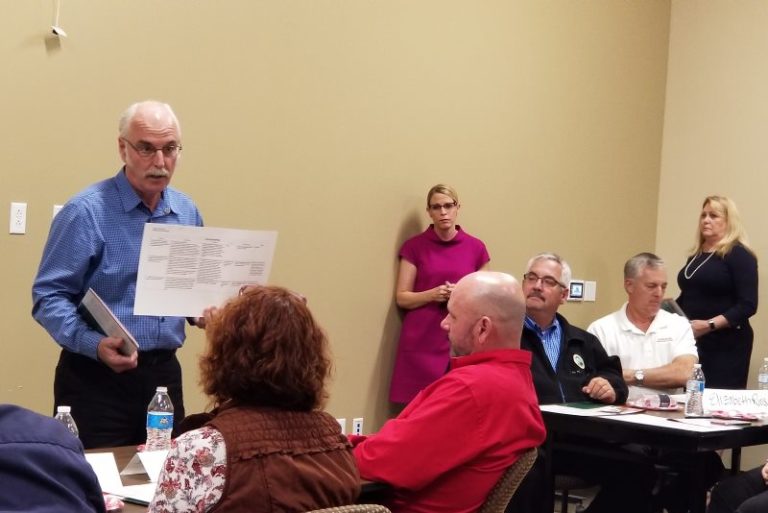

Sentinel staff report– A long-awaited action plan for improving a heavily trafficked commercial section of Auburn Boulevard in Citrus Heights was unveiled to a group of about 50 business representatives, city leaders, and property owners during a Nov.…