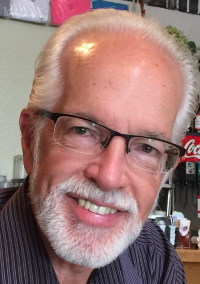

By Bret Daniels–

As a citizen of Citrus Heights for many years and serving on the City Council for ten years, I am very familiar with the inner workings of City Hall and how things are done. In this position, I have become very knowledgeable about the current and future financial status of the city, as well as Measure M – a full percent increase in the sales tax for the city to 8.75% – greater than all of our neighbors and equal to Sacramento City.

This increase would greatly harm the residents and business community of Citrus Heights. I urge you to vote NO on M.

A sales tax is the most regressive and hurtful tax to our residents, and it makes no sense to increase the tax burden upon residents during our current economic crisis and pandemic when thousands are out of work. Plus, this tax has no expiration date.

Measure M: Citrus Heights council votes 4-1 to put $12M sales tax increase on ballot

And, since the proponents of this measure use a lot of flawed reasoning in the attempt to justify this flawed tax, let me expose seven of these myths!

MYTH #1: Citrus Heights is in desperate need of money.

FACT: Incorrect. 1.) In two years, the city will receive an estimated $6,000,000 of new funds annually from Sacramento County property taxes. It has a two-year problem but is proposing an immediate “forever tax.”

2.) The city has a spending problem. For example, according to salary information posted on publicpay.ca.gov, there are city staff in Citrus Heights who are already paid more than the Governor!

MYTH #2: Measure M is unique in providing local control that cannot be seized by other governments.

FACT: The city always has complete control over all general fund tax revenues it receives – property tax, sales tax, etc. None of its general fund resources can be arbitrarily seized. The city is saying give us more money and we can stay in control. Whereas, they are already in control. They just want more money to do the things they want to do.

MYTH #3: Citrus Heights has a long history of fiscal prudence.

FACT: Citrus Heights HAD a long history of fiscal prudence. Until a few years ago the city carried $30,000,000 in reserves. Now the city is millions in debt! Overspending, high salaries, new city facilities, and the list goes on!

MYTH #4: Measure M prevents devastating cuts.

FACT: Untrue, the city just needs to reprioritize its spending, just as we do and any family does. Residents are not a bottomless pit of money. Plus, the city will receive millions in new property tax revenues in two years. They need fiscal prudence like they had a few years ago!

MYTH #5: The tax money will go to pay for police services, homelessness, roads, etc.

FACT: The promised list of “feel-good” spending is useless unless there are guarantees. There are no guarantees and politicians break promises. Read the measure. All funds go into the general fund and are “available for any lawful municipal purpose.” Funds can be used for salary increases, pensions, or whatever! If the city wanted all of the tax money to go to particular purposes, why didn’t they design the tax that way?

MYTH #6: Measure M will have citizen oversight.

FACT: Citizen oversight is after the fact, has no authority, and is a joke. The oversight committee is appointed by the City Council, almost certainly to their political insider friends. The measure says the tax revenues can be spent on any lawful purpose, which means it can be spent on anything! An annual report after the fact is mere window dressing.

Another view: Guest Opinion: Why I’m supporting Measure M

MYTH #7: The tax was developed with over a year of civic input.

FACT: The city spent a year asking a limited sample of people what they would like without discussing costs! A wish list. Want doughnuts for breakfast? Sure! How about other feel-good causes? Sure!

The reality is the city rammed through this tax at literally the last legal moment with extremely short notice and limited debate. And, the tax has no direct tie or guarantee to any of the proposed feel-good causes… such as homelessness, police services, and the like.

Let me implore you to vote NO on Measure M. Don’t let the city fool you into burdening yourselves and your neighbors during a national pandemic and economic crisis.

Bret Daniels currently serves on the Citrus Heights City Council and is a candidate for the District 1 council seat this year.

The Sentinel welcomes guest columns and letters about local issues. To submit one for publication: Click here